Quantum Computing: Reshaping Bankruptcy Law Dynamics

Reshaping Bankruptcy Law: The Quantum Computing Impact

Introduction to Quantum Computing in Bankruptcy Law:

The intersection of quantum computing and bankruptcy law unveils a new era in legal dynamics. This article delves into the transformative potential of quantum technologies on bankruptcy proceedings, highlighting the implications, challenges, and opportunities that arise in the evolving landscape.

Quantum Analytics for Financial Distress Prediction:

One of the significant impacts of quantum computing in bankruptcy law lies in its ability to enhance financial analytics. Quantum algorithms can process vast datasets at unprecedented speeds, enabling more accurate predictions of financial distress. This quantum-enhanced analytics empowers bankruptcy professionals with insights for early intervention and strategic decision-making.

Enhanced Contract Analysis with Quantum Computing:

Bankruptcy proceedings often involve complex contracts and agreements. Quantum computing’s advanced analytical capabilities allow for more thorough and rapid contract analysis. Legal professionals can leverage quantum algorithms to navigate intricate contractual relationships, ensuring a comprehensive understanding of obligations, rights, and potential liabilities in bankruptcy cases.

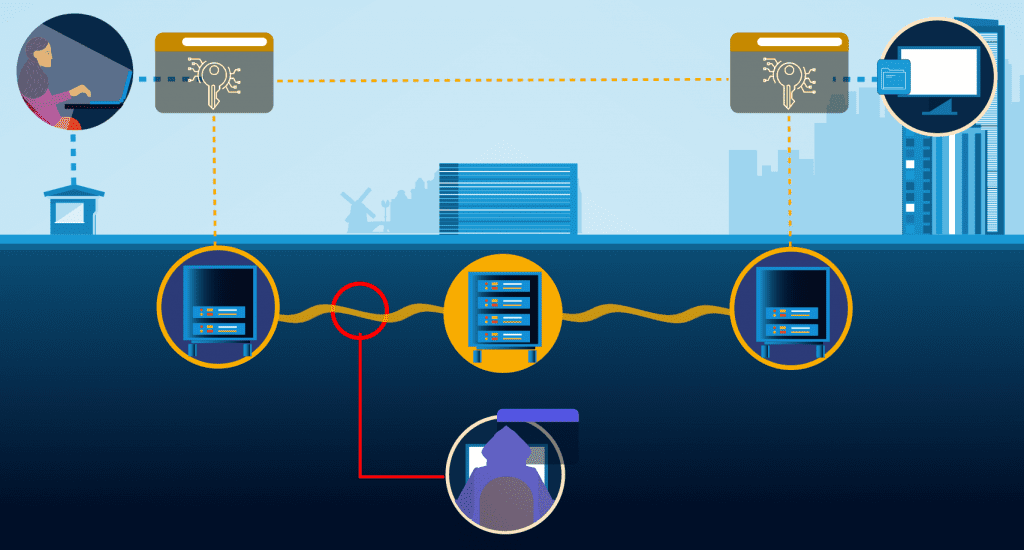

Quantum Encryption for Securing Bankruptcy Data:

As bankruptcy proceedings involve sensitive financial and personal data, ensuring the security of information is paramount. Quantum encryption, leveraging the principles of quantum mechanics, offers a new frontier in data security. Quantum-resistant cryptographic techniques can safeguard bankruptcy-related information, addressing concerns about data breaches and unauthorized access.

Challenges in Quantum-Enhanced Legal Decision-Making:

While quantum computing presents opportunities for advanced analytics, legal professionals face challenges in adapting to quantum-enhanced decision-making. Navigating the complexities of quantum algorithms and integrating their outputs into legal strategies requires a nuanced understanding. Legal frameworks must evolve to accommodate the unique challenges posed by quantum-enhanced decision support systems.

Quantum-Driven Automation in Bankruptcy Processes:

The automation of routine bankruptcy processes stands out as a key benefit of quantum computing. Quantum-driven automation can streamline tasks such as document review, case management, and procedural compliance. However, legal frameworks must establish guidelines to ensure the ethical and responsible use of automation in bankruptcy proceedings.

Regulatory Considerations for Quantum Technologies:

As quantum technologies become integral to bankruptcy law, regulatory frameworks must adapt to govern their use. Legal professionals need clear guidelines on the ethical, privacy, and security considerations surrounding quantum technologies in bankruptcy cases. Proactive regulatory measures can facilitate the seamless integration of quantum computing while safeguarding legal principles.

Quantum Literacy for Bankruptcy Lawyers:

The integration of quantum computing into bankruptcy law demands a new level of quantum literacy among legal professionals. Educational initiatives and training programs are essential to equip bankruptcy lawyers with the knowledge and skills required to leverage quantum technologies effectively. Quantum literacy ensures that legal practitioners stay ahead in this rapidly evolving legal landscape.

Addressing Ethical Implications in Quantum Bankruptcy:

The adoption of quantum computing in bankruptcy law introduces ethical considerations. Legal professionals must navigate issues of transparency, accountability, and fairness in the use of quantum-driven tools. Establishing ethical guidelines and standards becomes crucial for maintaining public trust and upholding the integrity of bankruptcy proceedings.

Future Perspectives on Quantum Bankruptcy Law:

In conclusion, the infusion of quantum computing into bankruptcy law marks a transformative period. For an in-depth exploration of Quantum Computing and Bankruptcy Law, visit StarMountainResources.com.

The future of bankruptcy law lies at the nexus of legal expertise and quantum technologies. As legal professionals embrace quantum computing, they are poised to navigate bankruptcy proceedings with unprecedented efficiency and precision, fundamentally reshaping the landscape of financial reorganization and legal decision-making.